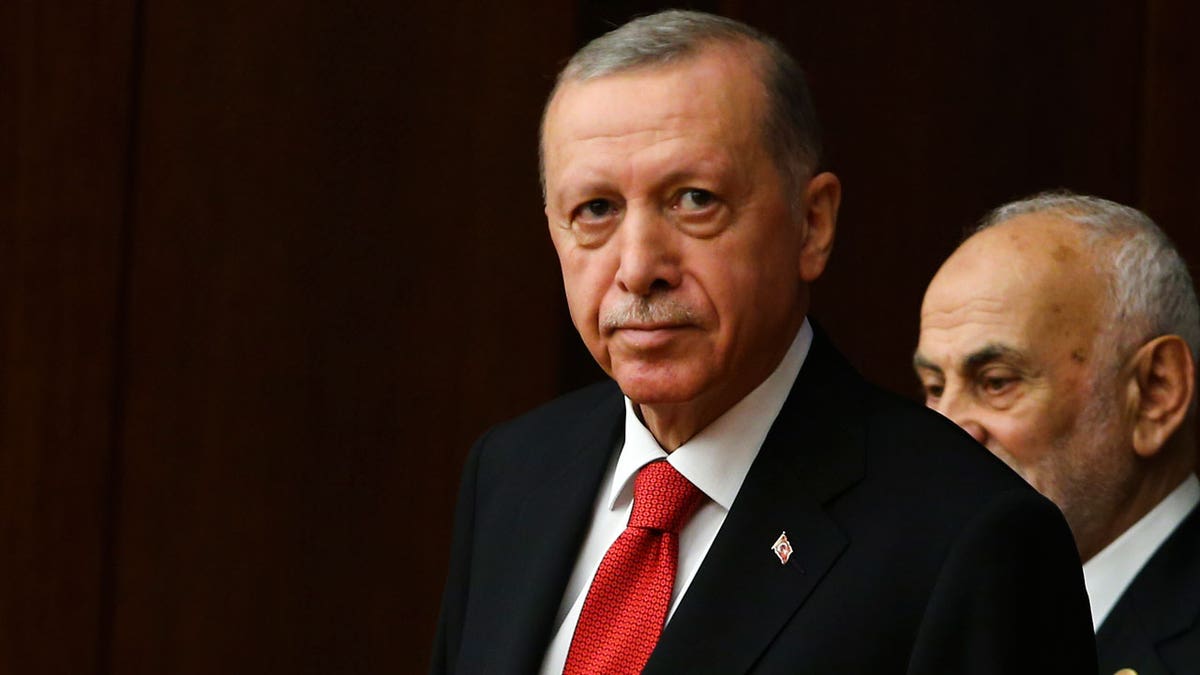

In a move suggesting a potential departure from unconventional economic strategies, Turkish President Recep Tayyip Erdogan has selected Hafize Gaye Erkan, a seasoned banking executive with experience in the United States, to helm the nation's central bank. This marks a significant development as Erkan becomes the first woman to hold this position.

Erkan, a Princeton graduate, brings a wealth of experience to the role, including a brief stint as co-CEO of First Republic Bank in 2021. This appointment follows the recent selection of Mehmet Simsek, a respected former banker, as treasury and finance minister, further fueling speculation of a shift in Erdogan's economic approach.

These appointments have sparked optimism that Erdogan, recently re-elected for a third term, might reconsider his stance on interest rates. His unorthodox view, which contradicts conventional economic wisdom, posits that lower interest rates can combat inflation. However, critics attribute Turkey's soaring cost of living, with inflation peaking at 85% last October, to this very approach. Global central banks, including the US Federal Reserve and the European Central Bank, have been raising interest rates to curb inflation.

Experts view Erkan's appointment as a positive sign, suggesting a move towards more reliable economic policies and potentially greater autonomy for the central bank. However, they emphasize the need for concrete policy changes to solidify this shift. The upcoming central bank meeting on interest rates will be a crucial indicator of the direction of Turkey's economic policy.

The Turkish lira and inflation, currently at 39.5%, are key challenges facing the economy. Erkan's ability to independently adjust interest rates, potentially significantly raising them, is seen as crucial. Maintaining higher rates to control inflation, despite potential impacts on economic growth, will be another important test.

Erkan's background includes roles at Goldman Sachs and First Republic Bank, the latter of which was acquired by JPMorgan Chase following its collapse earlier this year. She succeeds Sahap Kavcioglu, who oversaw a series of rate cuts since 2021 and now heads Turkey’s banking watchdog, BBDK. Some analysts see this appointment as a potential sign that Erdogan's economic policies could revert at any time. Rebuilding the central bank's credibility and independence after years of policy shifts and personnel changes will be a significant task for Erkan.