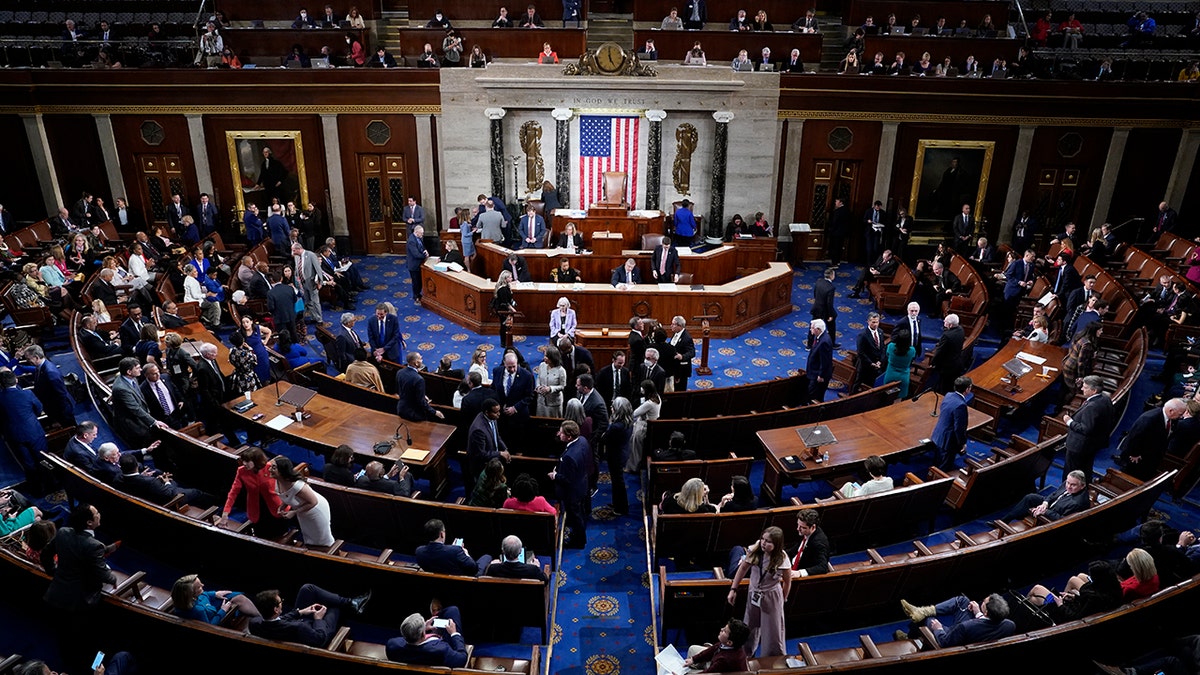

The House Republicans' new tax bill echoes previous tax cuts under Bush and Trump, primarily benefiting the wealthy while adding to the national debt. While unlikely to pass the Democratic Senate, this bill presents a crucial opportunity for Republican deficit hawks to demonstrate fiscal responsibility and engage in bipartisan collaboration.

Instead of perpetuating the cycle of tax cuts for the rich, Republicans should work with Democrats on tax reforms that address critical national needs. Their current approach undermines their credibility on fiscal matters, especially after narrowly averting a government default and voting to underfund IRS audits, disproportionately favoring corporations and millionaires.

A bipartisan approach to tax reform could yield significant progress. Previous successes in areas like infrastructure, gun safety, and marriage equality demonstrate the potential for cross-party collaboration. Republicans should leverage this momentum to enact meaningful tax reform.

Several potential areas for bipartisan tax reform include:

- Rewarding work, not wealth: Expanding the Earned Income Tax Credit (EITC) while repealing the step-up in basis for inheritance taxes, a provision that reduces capital gains taxes for heirs.

- Investing in research and development: Reversing the Trump-era requirement to amortize corporate R&D expenses, instead allowing expensing, and offsetting the cost by raising the minimum tax rate on corporate international income to 15%, aligning with international agreements.

- Supporting children: Revisiting the child tax credit, building upon previous proposals from both Democrats and Republicans like Senator Mitt Romney's plan.

By embracing bipartisan dealmaking, Republicans can enact responsible tax reforms that benefit all Americans, rather than furthering tax cuts for the wealthy and exacerbating the national debt. This approach would not only foster economic growth but also restore public trust in their commitment to fiscal responsibility.